Industry: B2B payments

Location: Australia

Solution: Embedded Payments

How SimpleRent built its disruptive payments software on the shoulders of Worldpay for Platforms

SimpleRent leverages Worldpay for Platforms’ Payment Engine to dominate the leasing and property payments software market

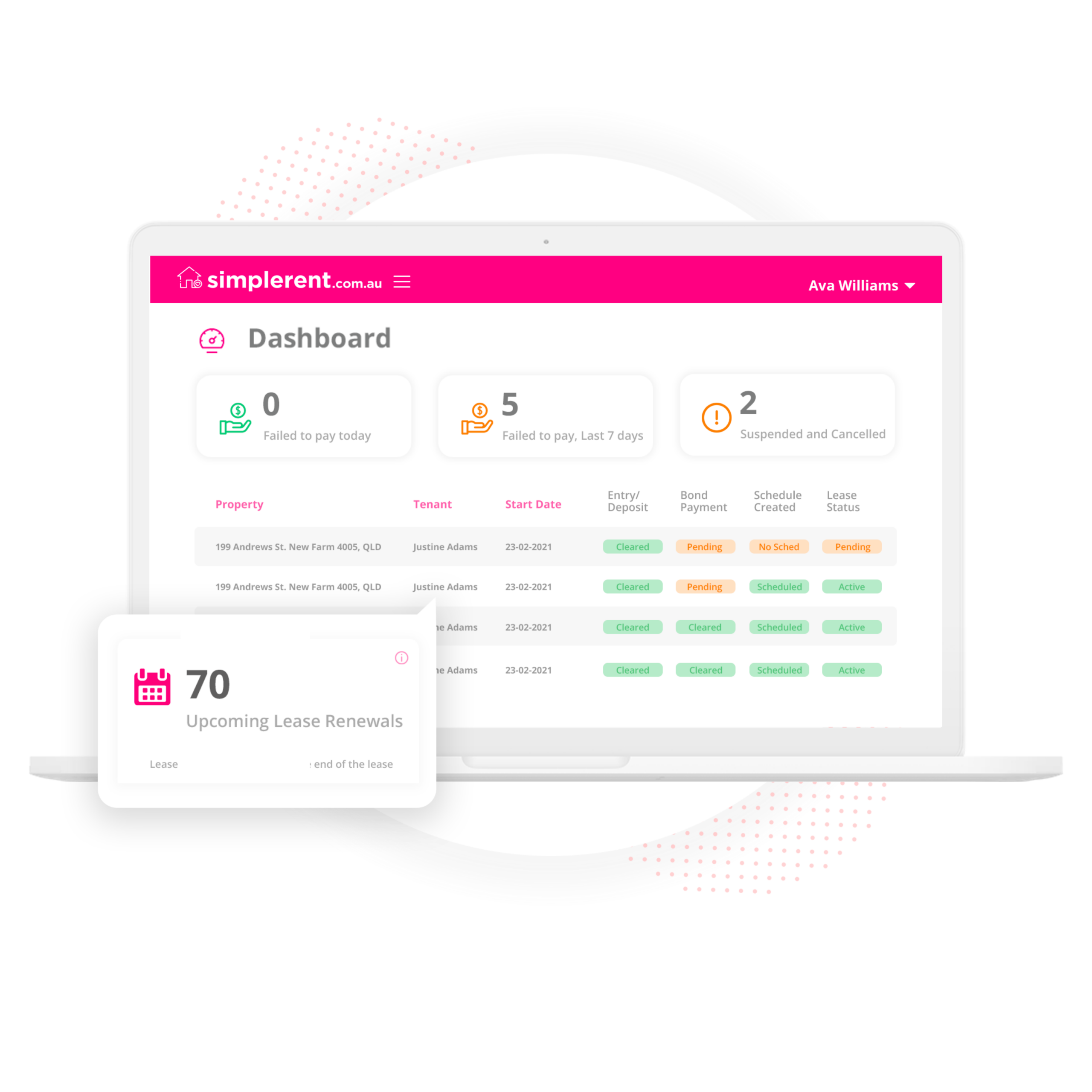

The platform wins clients by dramatically speeding up the leasing process, automating time-consuming payment collection processes, and rewarding tenants with shopping discounts to top retailers nationwide.

According to Matt Kesby, Head of Simplification at SimpleRent, success did not happen overnight. It required time, trial and error, and a key integrated payments partnership to build something scalable and sustainable.

Challenge

Historically, the residential property market has been underserved from a payments perspective, with limited choice and little innovation. At the same time, the industry has experienced a significant volume of software changes, creating additional complexity and stress for property managers.

Property managers can spend up to 20% of their working week on payment-related activities, often involving repetitive tasks across multiple systems. This frequently leads to double data entry, wasted time, and resistance to change, even when better solutions exist.

To drive adoption, SimpleRent needed to eliminate friction entirely. This meant creating a seamless experience that removed operational burden while supporting a disruptive business model. The software would be free for agencies, generating revenue through transaction margins instead. Tenants would receive added value through access to exclusive retail discounts via the SimpleDiscount program.

Solution

SimpleRent focused on mapping the entire property manager journey from start to finish and building a solution that automated payment and leasing tasks end to end. The platform invested heavily in personalisation and integrations with property management systems such as PropertyMe to deliver a seamless and effortless user experience.

This level of focus was only possible by leveraging the expertise and infrastructure of an integrated payments partner. By working with Worldpay for Platforms, SimpleRent did not need to build or manage a transaction engine or obtain an Australian Financial Services Licence, allowing the team to concentrate on delivering value through their software.

Worldpay for Platforms became the foundational payments engine on which SimpleRent built its overlays, automations, and integrations, supporting complex pricing models, multiple tiers, and scalable growth.

Without a doubt, Matt said that SimpleRent wouldn’t be where it is today without Worldpay for Platforms. “I told the team from the early days that we’re standing on the shoulders of giants. We couldn’t do this without open source and programming languages, cloud services and communications, hosting and so forth. As you go through the journey of building something great, have the humility and the gratitude to acknowledge those that are around you.”

That’s amazing advice for any startup. So what would Matt say to a young company considering payments?

“If you’re a startup, it will take three times as long and twice as much or twice as long and three times as much to get there [if you build it on your own]. Payments is a volume game if it’s a key part of your revenue model. Be willing to invest so that you can buy for the long term. It isn’t a short sprint. And take the time to plan, so you can make sure you get the most out of all services that are provided by an integrated payments partner. There’s a lot, a huge amount, in the underlying payments system to take advantage of.”

Partnership results

- Accelerated product development:

Worldpay for Platforms provided a powerful payments foundation, enabling SimpleRent to focus on building differentiated leasing and payment automation tools. - Reduced operational and compliance burden:

SimpleRent avoided the complexity of building and maintaining its own transaction engine and regulatory infrastructure. - Support for complex business models:

The partnership accommodated SimpleRent’s pricing complexity, tiered structures, and evolving commercial requirements. - Improved adoption and scalability:

Automated payment and leasing workflows reduced friction for property managers, encouraging adoption and long-term use. - Long-term growth enablement:

By leveraging an integrated payments partner, SimpleRent was able to invest for the long term rather than treating payments as a short-term build.

Curious to see what you could achieve with embedded payments?