Most payment cost discussions fixate on card fees. But for SaaS platforms and their merchants, the real margin killer is the old‑fashioned banknote, quietly draining profits through fees, labour, insurance and lost opportunity.

Cash is no longer king. An RBA consumer payments survey in 2022 found that just 13% of payments were made in cash , and that number keeps falling. Despite over $100 billion in banknotes circulating as of October 2024, most of it is held for savings or precaution, not everyday spending.

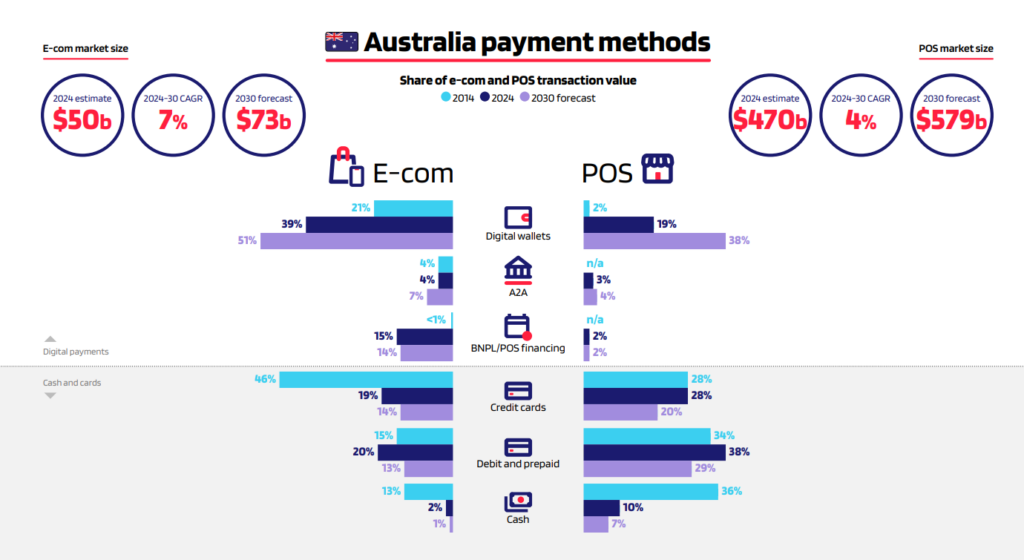

(Read the full Global Payments Report 2025 here)

For merchants, this shift isn’t just behavioural, it’s financial. Every dollar of cash accepted chips away at profit margins. Here’s a board‑level breakdown of why and how vertical SaaS can help merchants stem the bleed.

1. Direct bank fees tiny percentage, huge signal

Even before cash leaves the till, banks apply surcharges that scale with volume, unlike card fees, which often decline as merchants grow. with usage.

- Transactional merchants, take note. Banks in Australia surcharge cash with a variety of fees to cover their operational costs, labour and security processes.

- Across Australia, fixed fees can be anywhere from $3 to $6for banker-assisted deposits, withdrawals or cheques. What that means is a nominal 0.25% fee applied to a daily cash dealing of $5000, could incur a fee ~$520+ per year, even before the notes leave their till

- Likewise with deposit machines, that can charge up to $10 per transaction. Look for accounts that offer a free set of assisted transactions per month to help keep the volume of fees down.

- All these hidden cash costs scale linearly by volume, the more cash handled, the more you pay. In contrast, digital transaction costs often fall as merchants qualify for blended or interchange-plus pricing. Cash‑in‑transit (CIT) and network fragility

Once cash leaves the premises, it enters an expensive and fragile logistics chain, one that’s increasingly under pressure.

- Cash doesn’t teleport, it travels by armoured transport and Rising labour, fuel and insurance costs pushed the sector to accept a $50 million government lifeline in 2024 to stay afloat.

- Every pickup or change order attracts a higher tariff, and service windows have narrowing . When a CIT provider falters, merchants have no instant “fail‑over” like they do with digital rails.

2. Insurance — premiums tell the story

Insurance pricing reveals how the market perceives risk. Businesses handling cash face higher premiums due to theft, robbery exposure and larger on-premise floats.

- Hospitality venues: average business‑package premium around $140 per month.

- Generic public liability: around $39 per month for lower‑risk professional services that rarely handle cash.

- Insurers price in staff theft risk, hold‑up exposure and larger on‑premise cash floats. Reduce cash handling and you migrate to the cheaper risk class almost automatically.

Reducing or eliminating cash handling can automatically migrate a business to a lower risk insurance class and lower monthly premiums.

3. Labour, shrinkage and reconciliation

Independent retail research shows the all‑in cost of handling cash ranges from 4.7% to 15.3% of sales, depending on segment —well above typical card merchant discount rates. Where does that money go?

These costs aren’t just theoretical, they appear daily as staff time, errors, and reconciliation overheads.

| Cost driver | Typical impact |

|---|---|

| Manager time | 1–2 hrs/day counting, dual‑signing, safe drops |

| Back‑office | Bank runs, deposits and change orders |

| Shrinkage | ~0.3% of turnover lost to errors/theft |

| CIT contracts | $60–$100+ per pickup, rising with fuel and insurance |

Automating or eliminating manual tender counts can reclaim dozens to hundreds of staff hours per store each month, to redirecting time to customer‑facing work.

4. Opportunity cost — the silent killer

In a digital-first economy, cash is not just inefficient it is quite often invisible to the systems that drive growth.

- Reduced throughput: Counting change adds seconds per transaction. For appointment-based or high volume merchants, that’s lost revenue slots.

- Lost data: cash transactions vanish from loyalty engines, analytics, and upsell algorithms, — the lifeblood of modern vertical SaaS.

- Customer preference: With most consumers now preferring digital payment, insisting on cash can push high-value customers elsewhere.

- Cash still has its place. It remains a valid legal tender and certain demographics and regional merchants continue to rely on it. The RBA has reaffirmed its commitment to support cash access. But in a digitally mature economy, we need a clear-eyed assessment of its true cost.

What this means for vertical SaaS companies and their merchants

- Make digital the default: Embed PayTo, account‑to‑account and “pay by link” options directly into workflow. Offer tap‑to‑pay on phone so even micro‑merchants can ditch the float.

- Price the reality: help merchants benchmark their total cash cost versus. Digital payments. Once insurance, labour and shrinkage are factored in, digital almost always wins.

- Monetise the upside: every percentage point shift from cash to software‑initiated payments increases GMV, improves data visibility and expands opportunities for capital, loyalty and analytics add-ons.

- Plan for CIT disruption: for merchants who must keep some cash (e.g., regional fuel sites) encourage volume‑based CIT contracts and smart‑safes that offer provisional credit.

- Cash will persist in some sectors and communities, but its role is shrinking as every generation become more tech-savvy. . Why it matters to SaaS Platforms

In 2025, cash acceptance is a tax on growth. The direct bank fee may look small, but when you layer on CIT, insurance and hidden labour, notes and coins outstrip modern electronic fees by a factor of two or more, and the gap keeps widening.

Vertical SaaS platforms that embed streamlined card, account‑to‑account and wallet solutions are not just adding convenience; they are removing a structural cost that undermines merchant resilience The sooner merchants pivot, the sooner they can reinvest those savings into better staff, stronger customer experiences and ultimately — more revenue flowing through your platform.

Ready to help your merchants reduce cash costs and unlock new revenue streams? Let’s talk about how our embedded payments can make digital payments your default.